Consumers have shifted their mindset around food in exciting ways over the past year. Fewer restaurants, reduced human interaction and more at home dining are just a few of the changes we have seen due to Covid. Projecting whats to come in 2021 isnt quite the same as it used to be. In our latest food and beverage trend forecast we look at the highlights of the industry´s macro changes over the year which has been like no other.

The pandemic has completely knocked us off track in terms of our diets and healthy eating. With unstable routines, stress and panic shopping consumers have started to gravitate towards more comfort foods and sugary snacks. Over 3 in 4 Americans surveyed said they gained up to 16 pounds in isolation. On the contrary, AI-powered data company TasteWise reported earlier this year that “immunity” related searches had spiked 27% and health and wellness startups were on the rise, as the pandemic forced consumers to rethink their lifestyle habits.

Data and traceability

The global food traceability market size is expected to rise to $19,980 million by 2025. Supply chain digitalization is becoming increasingly more important for conscious consumers and the more information they have access to, and the better understanding of product information and choices they have the more trustworthy and close a relationship their brands can develop with them. Companies are being pushed to produce information that is both clear and transparent to provide products that meet evolving demands including animal welfare, sustainability, supply chain transparency and healthy eating.

According to Lu Ann Williams, director of insights and innovation at Innova Market Insights; “transparency throughout the supply chain will dominate in 2021, with consumers searching for brands that can build trust, provide authentic and credible products and create shopper confidence in the current and post-Covid climate”. The Innova Consumer Survey 2020 reveals that six in ten global consumers are interested in learning more about where their foods come from.

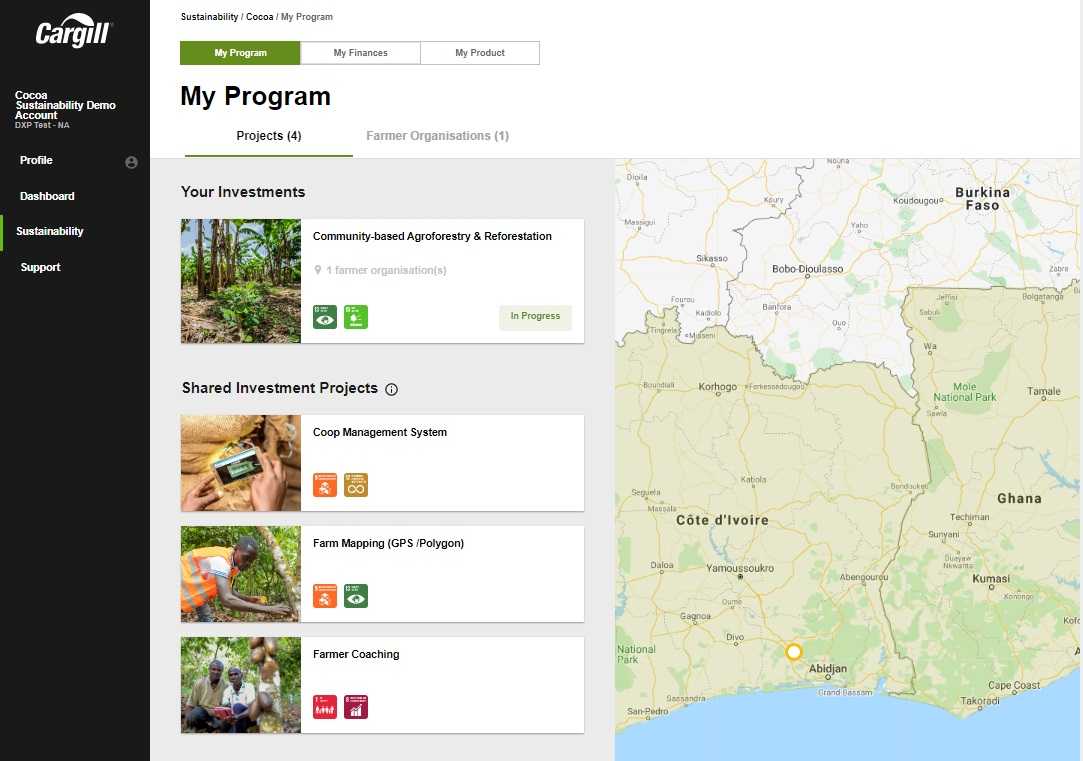

How do manufacturers and food producers address these new demands in their industry? First, they must be prepared to consider and embrace new innovative technologies that can offer extra insight into supply chain from farm to fork. Technologies like blockchain and artificial intelligence are shifting from “nice to have” to “must have” – including invisible barcodes, better online communication and sustainable packaging. Take Cargill’s recently launched CocoaWise portal for example, designed for food manufacturers it aims to boost transparency in the company’s cocoa supply chain.

( Image courtesy of Cargill)

( Image courtesy of Cargill)

With full, real-time visibility CocoaWise™ allows customers to be more deeply connected to the communities where they purchase their cocoa and see first-hand the impact of financial investments in the small farming communities such as providing sustainable agriculture coaching for farmers, entrepreneurship trainings for women and nutritional programs for families.

The power of protein

Plant-powered protein is going mainstream, arriving in “typically” meat-eating countries there has recently been an influx of new alt protein startups and a boom of funding from accelerators and investors. Thanks to its rising popularity, plant-based alternatives are reaching global status.

( Image courtesy of The Vegetarian Butcher)

( Image courtesy of The Vegetarian Butcher)

Consumer goods giant Unilever has eyed a $1 billion industry for meat and dairy alternatives by 2027. Their aim? To roll out The Vegetarian Butcher brand and propel vegan alternatives from brands like Hellmann’s and Magnum. The company is on a mission to drive people towards a healthier diet and help reduce the international chain´s substantial environmental impact.

“We have a critical role to play in helping to transform the global food system.” – Hanneke Faber, president of Unilever’s Foods & Refreshment Division.

McKinsey’s 2019 report also looked at the alternative protein market, revealing that plant-based food sales increased by 17 percent in 2018. In 2019, UBS estimated the plant-based-protein or alternative-meat market to grow 28% a year reaching over $85 B in 2030. But what about 2020?

We can safely say its been the year of plant-based meat. Investors were betting on the plant-based protein sector with more than 20 faux meat startups raising over $1.4 billion from venture investors in the first seven months of 2020, according to a report from London-based investor network Farm Animal Investment Risk & Return.

Consumers cant get enough of plant-based protein, and this isnt going to change come 2021. A new consumer study in Europe conducted by Berlin plant-based supermarket chain Veganz examined the changing attitudes of over 2,600 shoppers across Germany, Austria, Switzerland, Belgium, France, Portugal and Denmark, and found this year that nearly a quarter of the population in Germany are now actively reducing their meat intake. Within the last four years alone, the number of vegans in Europe has doubled from 1.3 million to the current estimated figure of 2.6 million, representing 3.2% of the population, meaning that almost a third of all Europeans no longer consider themselves full meat-eaters anymore.

Food as a medicine

The global Covid-19 pandemic has affected every aspect of the industry and our collective way of life but it has also created an opportunity for new business opportunities to emerge. One of those: the food-as-medicine movement. The ongoing anxiety from COVID-19 is encouraging consumers to seek more immunity boosting products and those with added health benefits into 2021. According to the Innova Consumer Survey 2020 six out of 10 global consumers are increasingly looking for food and beverage products that support their immune health, with one in three saying that their concerns about immune health increased in 2020 alone.

Functional drinks brand Purearth which develops 100% organic immunity boosting wellness shots and fermented gut-support drink Water Kefir recently reported a 254% sales uplift since lockdown. Between April and June the company sold four times more Water Kefir than the preceding three months and co-founder Tenna Anette has no doubt that its a covid-related sales surge. Speaking to the Welltodo news platform, Anette stated that “The pandemic has led many to review their lifestyle and seek out gut-loving and immunity-boosting ingredients to help strengthen their immune system. In the current climate, the need to nourish our bodies has never been more pertinent.”

( Image courtesy of Pureearth)

( Image courtesy of Pureearth)

Immunity boosting counterpart Vital Proteins also saw its sales surge due to covid with sales of their collagen-based powders and proteins experiencing a whopping 50% increase in sales. Which shows just how many cues the future of immunity boosting food will take from the supplement market. According to Market Research, over 50% of consumers reported taking more supplements to support their immune health in 2020.

Supplements, collagen powders, adaptogens, probiotics..alternative remedies are expected to continue to increase well into 2021.

Omni-channel eating

Globally, online sales will make up 15-20% of the food and beverage industry’s overall sales by 2025: 10 times more than it did in 2016. Why? The pandemic has completely tarnished the foodservice and retail industry this year and a number of food companies decided to shift online in order to create new revenue channels and business opportunities. The direct-to-consumer model is nothing new in food, but covid definitely helped accelerate it. The biggest foodtech entrants? Impossible Foods and Beyond Meat, the plant-based meat pioneers that dont require any introduction, both debuted their own d2c e-commerce earlier this year, a quick reaction to the effects of the pandemic.

Selling your products online is a new modern opportunity for food producers to reignite their growth and as food startups already compete in red oceans of giant retailers and digitally native brands, even pre-covid, it certainly doesnt hurt to build another channel and ensure increased consumer adoption rates, better user experience and create a closer relationship with your customers.

With major food players powering their D2C efforts including the likes of Heinz, Coca-Cola and Pepsi, smaller companies were on the clock to increase theirs. Dirtylemon and Naturebox both decided to jump on the e-commerce bandwagon, the latter deciding to pivot its business model for a third time during the pandemic, now developing an all-in-one automated solution delivering personalized snack boxes to offices and at home consumers.

( Image courtesy of HelloFresh)

( Image courtesy of HelloFresh)

With hospitality and foodservice out of the way, and increased home cooking during lockdowns, the once obsolete meal kit culture has made a comeback. Berlin´s meal kit provider HelloFresh saw its sales surge 90% at the beginning of 2020 compared to the previous year due to bored locked down consumers looking for something to do. The Innova Consumer Survey 2020 found 46% of consumers believe restaurant-branded products are a convenient way to attain the restaurant experience and flavours at home. Along with restaurant delivery growing, consumers can now directly access many specialty products that were previously only accessible via foodservice.

The 2020 foodtech motto? Online first.

What food trends would you like to see in 2021?